Legal Exemptions On Income Tax Payment – An Expert Advice

The following exceptions are legal ways to claim income tax deductions or exemptions, and thus save you thousands or lakhs of rupees which you might other wise pay as tax.

Section 80C Exemptions– Max Limit Rs.1 Lakh

- Provident Fund (including Public PF)

- Fixed Deposits (>= 5 Yrs)

- NSC

- Insurance / Pension Plan

- Unit Linked Insurance (ULIP)

- Equity Linked Savings Scheme (ELSS)

- Tuition fees of children

- Repayment of principal on housing loan.

Additional Income Tax Exemptions

Section u/s 80CCF- Infra structure bonds

Rs.20000 per annum

Medi-claim Policy:

Rs.15,000 can be deducted from taxable income of you.

Rs.15,000 paid for your parents policy can be deducted from your income.

Rs.20,000 for senior citizens.

Donation to a recognized Charitable trust.

Deduction under section 80G of the income tax act,1961.

Interest on the loan of a residential self occupied house property

Rs. 1.5 Lakh

(Very Important : For a home loan for around 20 lakhs, you might need to pay an interest of around 1. 5 lakh per year, and you can deduct this interest amount from the taxable income while calculating income tax).

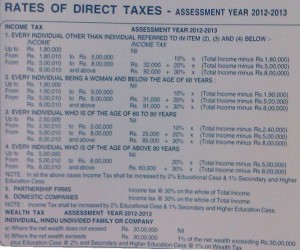

Basic Exemptions while Calculating Taxable Income:

- House Rent Allowance – As per HRA rules

- Conveyance Allowance – Max Rs.800 per month

- Leave Travel Allowance – 2 times in 4 years

- Medical Reimbursement – Max 15000/- per annum

Income Tax Rules To Keep In Your Mind

- Gifts from relatives are not taxable.

- Gifts from non-relatives upto Rs.50,000 are not taxable.

- Gifts from non=relatives on the occasion of marriage are not taxable.